Forget “Buy Local.” A Growing Movement Is Urging People To Take Grass-Roots Support Further And Invest Local.

It’s the kind of story people hear all the time.

Two years ago, Rick Stender found out that a local business he liked—a custom-bike maker—was in big trouble. The shop needed money to import extra bike parts for the holiday rush. And banks wouldn’t extend any credit to such a young company.

Many people would have tried to give the store some extra business by buying a new bike, or urging friends to stop in. Many others would have simply shrugged.

Mr. Stender wrote a check for $20,000.

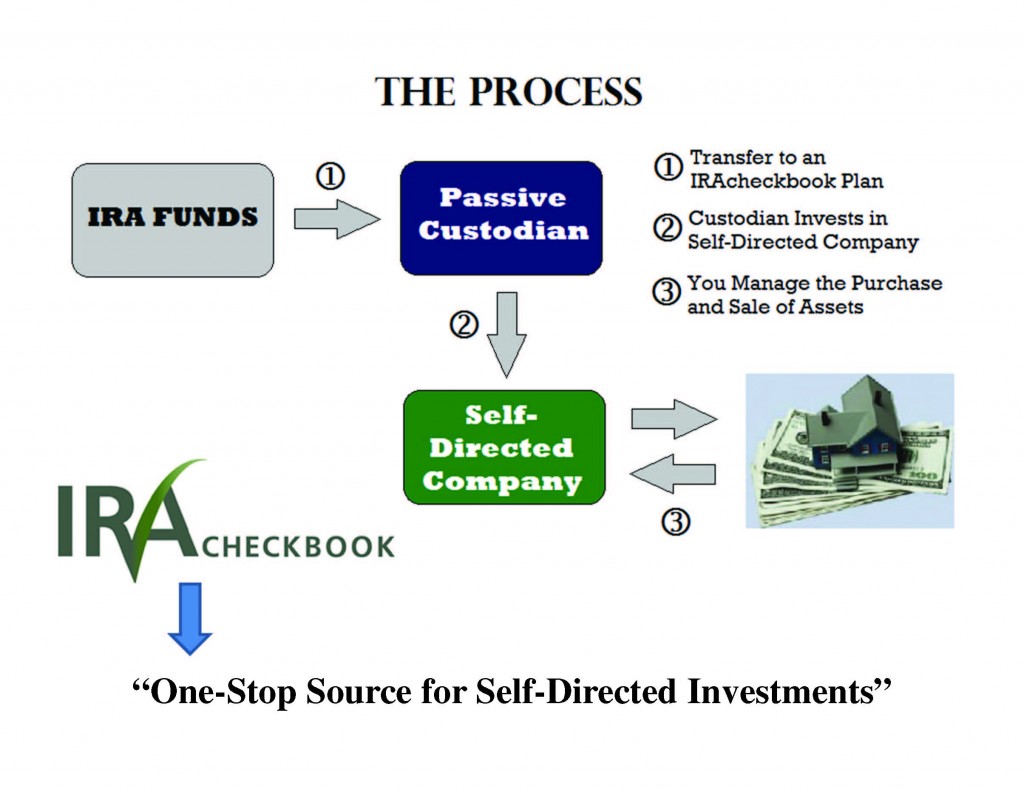

We found this article to be a third party confirmation of what Self Directed investors can do with the proper tools, resources and a self directed IRA.

We found this article to be a third party confirmation of what Self Directed investors can do with the proper tools, resources and a self directed IRA.