IRA Checkbook Premier Self Directed IRA Facilitators

IRA Checkbook Premier Self Directed IRA Facilitators

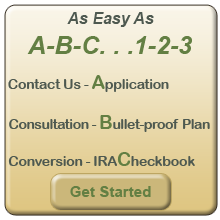

Self directed IRA facilitators are professional service companies that help people set up self-directed IRAs. Properly setting up your self-directed IRA or self directed SEP IRA, or self directed 401k requires a level of tax and legal knowledge that most people don’t have total access. Unless you are a tax attorney, it is probably a good idea to seek help if you want to set up a self-directed IRA. We have helped people just like you set up a self directed IRA checkbook so they could use the checkbook IRA to buy real estate (so they call it a self directed real estate IRA or real estate 401k), or invest in tax liens (so they want an alternative investment IRA), and some want to invest in precious metals (so they ask for a gold IRA). Actually these are all set up using the same self directed IRA rules.

What does a self directed IRA facilitator like IRAcheckbook do?

1. Answer your questions, and educate you on how to avoid self directed IRA prohibited transactions

2. Create an Limited Liability Company (LLC) on your behalf that is properly structured

3. Help create a new self directed IRA account for you with a licensed self directed IRA custodian

4. Assist you with rolling over your IRA or 401k funds into the new self-directed IRA

5. Ensure that the self directed IRA’s investment into the Limited Liability company (LLC) is done correctly

6. Make the process as quick and simple as possible for you via phone, fax and FedEx.

As Self-directed IRA facilitators we never handle your money directly. We assist you with filling out rollover documents, setting up bank accounts and so on, but never actually handle your IRA or 401k funds. The sooner you give us a call at 800-530-8522 we can review your investment goals and explain the benefits and applications of the self directed IRA.

[aio_button align=”none” animation=”none” color=”red” size=”medium” icon=”none” text=”Free Consultation” relationship=”dofollow” url=”https://iracheckbook.com/contact-us/”]

No time to talk now? Get the facts via email HERE.

Read More Details, Including a checklist to see how we stack up is available at NuWire Investor

You always hear about Self Directed IRAs and its flexibility regarding various investment opportunities. It is where your IRA funds are easily accessible through a checkbook IRA. We will now talk about some of the options you can choose in terms of real world investments. One of the simplest and in fact safest ways to go is buying the right franchise from your Self Directed IRA. Now you may be wondering why buy a franchise and not just go with the traditional option of purchasing stocks and bonds with your IRA funds? Let us discuss some of the advantages of a self directed IRA funding a franchise.

You always hear about Self Directed IRAs and its flexibility regarding various investment opportunities. It is where your IRA funds are easily accessible through a checkbook IRA. We will now talk about some of the options you can choose in terms of real world investments. One of the simplest and in fact safest ways to go is buying the right franchise from your Self Directed IRA. Now you may be wondering why buy a franchise and not just go with the traditional option of purchasing stocks and bonds with your IRA funds? Let us discuss some of the advantages of a self directed IRA funding a franchise.  There’s never a bad time to start thinking about your retirement. One of the best things that you may want to consider is an IRA. Short for Individual Retirement Arrangement, these types of Individual Retirement Funds were introduced in 1974 along with the roll out of the Employee Retirement Income Security Act.

There’s never a bad time to start thinking about your retirement. One of the best things that you may want to consider is an IRA. Short for Individual Retirement Arrangement, these types of Individual Retirement Funds were introduced in 1974 along with the roll out of the Employee Retirement Income Security Act. The availability of self-directed investments in retirement plans and individual retirement accounts (IRAs) may tempt plan participants and IRA owners to get creative in investing their retirement assets. Unfortunately, that can lead to some unexpected and adverse tax consequences.

The availability of self-directed investments in retirement plans and individual retirement accounts (IRAs) may tempt plan participants and IRA owners to get creative in investing their retirement assets. Unfortunately, that can lead to some unexpected and adverse tax consequences. If you are thinking ahead to retirement, it is important for you to understand just what an IRA is, and how it is supposed to work. IRA is short for Individual Retirement Arrangement. With a self managed IRA, money is deposited on a regular basis. Sometimes it is deposited in after taxes, and sometimes before. For a majority of people, a no fee IRA is the preferred choice.

If you are thinking ahead to retirement, it is important for you to understand just what an IRA is, and how it is supposed to work. IRA is short for Individual Retirement Arrangement. With a self managed IRA, money is deposited on a regular basis. Sometimes it is deposited in after taxes, and sometimes before. For a majority of people, a no fee IRA is the preferred choice. Did you know that American IRA funds amount to at least one trillion dollars, and, according to the Employee Benefit Research Institute (EBRI), U.S. men and women contribute to more than 15 million active IRAs? The cost of living is higher than ever, and that reality becomes especially relevant during retirement. Living the rest of your days comfortably, and without worry, depends on decisions you make today. Make the right decisions. Start by identifying, and clarifying, the following myths about IRAs.

Did you know that American IRA funds amount to at least one trillion dollars, and, according to the Employee Benefit Research Institute (EBRI), U.S. men and women contribute to more than 15 million active IRAs? The cost of living is higher than ever, and that reality becomes especially relevant during retirement. Living the rest of your days comfortably, and without worry, depends on decisions you make today. Make the right decisions. Start by identifying, and clarifying, the following myths about IRAs.