For a certain breed of conscious consumer, shopping locally is paramount. It signals support for independent stores over big chains, urban downtowns over sprawling shopping centers, small farmers and craftsmen over multinationals. The theory is that a bigger piece of each dollar spent locally stays in the community, as those business owners buy from local suppliers and reinvest profits close to home.

New JOBS Act Will Revolutionize Retirement

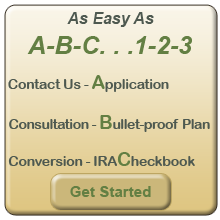

The recently passed JOBS Act may go down as one of history’s most revolutionary pieces of legislation, relative to the future of planning and investing for retirement. The bill is designed to make it easier for small business to access investment capital and, by doing so, will create a new, Crowd-funding asset class as well as bring self-directed IRA’s out of the shadows and into the spotlight.

Can you finance a house with your IRA? – As seen on The Today Show

The Elephant in the Alternative Investment Living Room

Remember the old line about the “elephant in the living room” and how it referred to a subject no one wanted to address even though it was obviously something that should be discussed? Well, there’s an elephant in the alternative investment (AI) industry living room right now, and he’s been there quite a while. But in this case, the first firm to start talking about him will benefit by gaining substantial sales!

A Decade Long Slump in the Stock Market has Piqued Interest In Alternative Asset

A recent study by Cerulli Associates, Inc. indicates that more than $1.1 trillion of investment money moved to the self-directed market between 2008 and 2010. According to Arthur Steinmetz, of Oppenheimer Funds, Inc., “the decade-long slump in equity prices boosted interest in alternative assets.” He went on to say that even when the market “and stock prices rebound investors should continue to hold alternative assets.”

IRAs Get Sexier by The Wall St Journal

Presidential candidate Mitt Romney has gotten lots of attention for holding as much as $100 million in his individual retirement account.

Less well known is that the account is also chockablock with complex private partnerships rather than the traditional stocks, bonds and mutual funds that make up most IRAs.

Following a decade of market turmoil, Mr. Romney isn’t the only one wise to the fact that IRA rules allow enormous latitude in choosing investments.

Entrepreneurs turn to 401k to fund start up business – By USA Today

Don Poffenroth paged through a magazine on a flight several years ago when an article grabbed his attention: Entrepreneurs could use 401(k) savings to start a business without getting hit by taxes and early-withdrawal penalties.

He and a partner had drawn up plans for a gin, vodka and whiskey distillery in Spokane, Wash., but they struggled with the best funding options.