IRAs are a popular retirement tool, but many people do not know that a self-managed IRA is an option. The advantage of a self-managed IRA is that you decide what to invest in, whether it be traditional or non-traditional investments. You may choose to invest in things that the managers of a more traditional IRA will not – including real estate. Real estate is a good long-term investment, and IRA funds are well suited for longer term investing.

IRAs are a popular retirement tool, but many people do not know that a self-managed IRA is an option. The advantage of a self-managed IRA is that you decide what to invest in, whether it be traditional or non-traditional investments. You may choose to invest in things that the managers of a more traditional IRA will not – including real estate. Real estate is a good long-term investment, and IRA funds are well suited for longer term investing.

What is a Self Directed IRA?

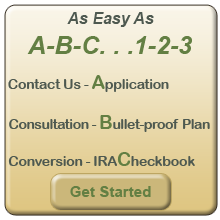

IRS Publication 590, Individual Retirement Arrangements, explains the different types of IRAs. The traditional Individual Retirement Account is one type; the self-directed one is another. You decide how the money in your self-directed IRA is invested by working in coordination with a trustee. You become your own “wealth advocate” and will quickly find out how easy the process can be even for the less experienced investor. Certainly there are “do’s and don’ts” of self-directed IRAs, but with the right facilitator and custodian, this structure becomes a real advantage to the investor and opens many doors once reserved only for a select few.

Why Real Estate?

Unlike stocks and bonds, real estate is, well, real — it is a tangible asset with real value that doesn’t usually fluctuate with the whims of Wall Street. Buying rental properties, especially multi-tenant properties, provides steady income to the IRA and diversity in more ways than you might think. There is the obvious fact that you can put money into real estate, stocks, bonds and other types of investments; however, you can also choose multiple types of real estate – rental properties (commercial and/or residential), undeveloped land or even value properties that are often referred to as “ flipped” or “flips”.

Things to Know

- Be patient – Creating a self-directed IRA can take time, usually about three weeks. Also, many custodians don’t allow for self-directed accounts.

- Financing- The down payment on a property can be from the IRA. This is a great way to leverage the investment. You should contact an IRA facilitator that can guide you towards a lender that accepts IRA loans.

- It is still an IRA – All profits from the property have to go into the IRA, and you cannot benefit from it before retirement. Also, you cannot live in or use the property yourself.

- It is still an IRA, the up-side – The income from the real estate is tax deferred (or in the case of a Roth IRA, tax free) , and you can make other tax deductible contributions to the account, as long as you don’t go over the annual contribution limit.

- An IRA is an individual account – You have to avoid conflicts of interest, so your spouse or children cannot be part of the deal and neither can your parents or grand parents. .

- It’s not a ‘set it and forget it’ investment – All expenses associated with the property have to be paid from the IRA account.

Real estate can be a very good investment. With self directed IRA real estate investments, you can broaden the scope of a retirement plan and utilize your money the way that you want to.