6 Do’s and Don’ts of Self Directed Retirement Investing

by Amanda Han on August 21, 2013 · 33 comments

If you have taxes due for the September or October 15th deadline, you may want to work with your tax advisor to find ways to pay towards your retirement account rather than the IRS. The goal with self directed retirement investing is to shift money that would otherwise go to the IRS into your retirement account. This is completely legal and specifically allowed by the IRS. In fact, the IRS wants you to do it.

Did you know that most people can put way more than the $5,500 or $6,000 into a retirement account? In fact, you may be able to put over $100,000 per year into a retirement account and take a $100,000 tax deduction for it.

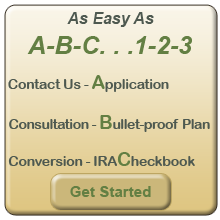

If you are just getting starting investigating the self directed IRA or you want to advance your knowledge with new ways to invest in alternate investments and the rules of the SDIRA, then request our 5 Part Series on the Self Directed IRA.

https://www.getdrip.com/forms/